Donald Trump carried a strong position on changing American trade policies with him when he took office in January 2017. In order to solve what he called unjust trade agreements that had resulted in significant deficits and the loss of domestic jobs, He pledged to give priority to American workers and industries. Tariffs, or levies on imported goods, were a key component of his strategy for safeguarding American industry and rebalancing trade ties.

Known as the “tariff game,” this aggressive tariff policy generated discussion and attention throughout the world. It changed economic strategy across continents, strained diplomatic relations, and interrupted international commerce flows.The consequences were immediately felt by many Americans in the goods they purchased, the jobs they had, and the prices they paid. However, why was this tariff game started? What impact did it have on the world economy? Who really profited and who lost out? What were the opinions of economic experts and world leaders?

We’ll examine the beginnings, effects, and subtleties of Trump’s tariff policy in this extensive blog, breaking out the winners and losers and what the whole story means for you.

Table of Contents

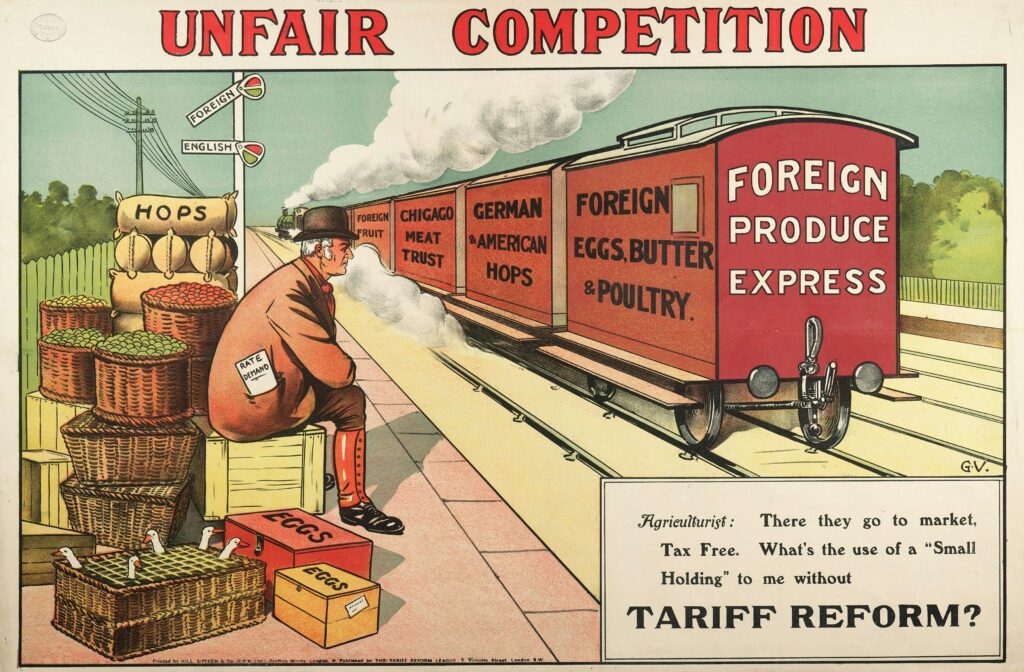

The Origins of the Tariff Game

The cornerstone of his tariff plans was his pledge during the campaign to “Make America Great Again.” He maintained that unfair practices and trade imbalances had been exploited by other nations, especially China, at the expense of American workers as a result of decades of globalization.

The Need for Action and Trade Deficits

The ongoing trade deficit the US has with nations like China, Mexico, and others was one of the administration’s main complaints. When a nation imports more things than it sells, money leaves the country, creating a trade deficit. These deficits, Trump and his staff argued, were a reflection of unfair trade practices, such as intellectual property theft, currency manipulation, and restrictions on U.S. exports.

Tariffs on Steel and Aluminum: The First Step

Citing national security concerns, Trump announced a 25% tariff on imported steel and a 10% tax on aluminum in March 2018, marking the first significant tariff imposition. Although China was the primary target of this action, other significant exporters such as the European Union, Canada, and Mexico were also impacted.

With cheaper imports flooding the market, the indigenous steel and aluminum sectors had been struggling; these taxes were meant to help them recover. Trump claimed that in order to maintain jobs and compete fairly, American producers required protection.

Escalation into a conflict with China over trade

Things quickly got out of hand. Targeting industries such as electronics, machinery, and automobiles, the United States levied duties on $34 billion worth of Chinese exports in July 2018. China responded by imposing taxes on American manufacturing and agricultural goods.

The two economic superpowers raised tensions and started what many referred to as the most important trade war since World War II by exchanging duties on hundreds of billions of dollars’ worth of goods over the course of the following year.

Beyond China: European Union and Mexican Tariffs

His tariff policy was not limited to China. Concerning everything from immigration to aircraft manufacturing subsidies, the government levied taxes and threatened more on imports from Mexico and Europe. These actions were a part of Trump’s larger initiative to renegotiate trade accords, which also included the USMCA (United States-Mexico-Canada Agreement) replacing NAFTA.

Impacts on the World Economy

His tariff strategy had far-reaching repercussions on the world economy. Despite being intended to safeguard American interests, the regulations severely hampered global trade and caused uncertainty that affected companies all over the world.

Disruptions in the Supply Chain

Global supply chains play a major role in modern production. A single product’s components may come from multiple nations, be put together in another, and then be sold all over the world. This carefully calibrated mechanism became unpredictable due to tariffs.

In order to escape tariffs, businesses had to either absorb the increased input costs, raise prices, or move production. This resulted in:

- Manufacturing delays

- Higher running expenses

- Reevaluating sourcing tactics, frequently shifting manufacturing to nations exempt from tariffs

- For instance, taxes on steel and aluminum increased the costs for automakers, which in turn affected the U.S. automobile industry.

The End of the World Is Just the Beginning: Mapping the Collapse of Globalization―The Collapse of Globalization

Increased Costs for Customers

Early on, a number of economists noted that tariffs are essentially taxes that eventually trickle down to consumers. Retailers passed on the increased costs of goods that depended on imported components to the supply chain.

The cost of many commonplace items, including food, clothing, appliances, and gadgets, increased for Americans. Farmers experienced financial difficulty and lost markets as a result of China’s retaliatory tariffs on commodities such as pork and soybeans.

Global Trade and Growth Slowdown

The global slump was exacerbated by trade tensions. The growth of the global merchandise trade decreased from 4.7% in 2017 to just 1.2% in 2019, according to the World Trade Organization.

Businesses postponed expansions and investments due to tax uncertainty. Due to their heavy reliance on exports, several emerging countries experienced difficulty when major nations’ demand decreased.

Trade barriers and retaliatory actions

Retaliatory taxes on American goods were imposed by nations that were impacted by U.S. tariffs. In addition to increasing exporters’ expenses, this tit-for-tat caused volatility in global markets.

The trade war exposed the vulnerability of global trade governance by undermining long-standing multilateral organizations like the WTO.

benefits for the United States

Trump’s tariff strategy had some benefits for the US, despite intense criticism.

Encouragement of Domestic Production

Some industries saw a resurgence, including steel and aluminum. There was less competition from overseas and more demand for domestic producers’ goods.

Steel mills in states like Ohio and Pennsylvania, for instance, claimed increased production capacity and higher earnings. Some jobs in previously declining industries were preserved as a result.

A more powerful negotiating stance

One tactic used to get trading partners to the negotiating table was tariffs. In order to obtain new accords that addressed forced technology transfers, market access, and intellectual property theft, the United States used tariffs as leverage.

China agreed to buy more American goods and improve intellectual property safeguards as part of the “Phase One” trade agreement with the United States that was inked in early 2020.

Transition to Fairer Trade

The necessity for more equitable trade agreements that safeguard American companies and workers was brought to light by the tax. It caused long-standing trade agreements and regulations to be reevaluated, encouraging an emphasis on “fair trade” as opposed to just “free trade.”

With clauses more advantageous to American businesses, such as the automobile industry, the renegotiated USMCA took the role of NAFTA.

The Views of World Leaders and Experts

Trump’s tariff gambit sparked a diverse and frequently divisive response around the world.

The Viewpoint of Supporters

Proponents contend that in order to combat unfair trade practices and safeguard American sovereignty, the tariffs were required. They attribute the revival of important industries and the compelled behavior change of enemies like as China to tariffs.

For instance, several industry CEOs and labor groups hailed the protective tariffs because they thought they saved thousands of jobs.

The Viewpoint of Critics

The tariffs were strongly criticized by economists and trade experts, who highlighted how they would disrupt markets and international collaboration.

Many cautioned that tax are regressive taxes that disproportionately harm customers with lower and medium incomes. Price hikes exceeded salary gains, according to studies, which put pressure on household budgets.

Additionally, experts warned that trade wars run the risk of destroying diplomatic ties and creating risky precedents for protectionism.

Perspectives of World Leaders

Chinese President Xi Jinping emphasized communication above confrontation and denounced the taxes as a type of protectionism. Concerned, the European Union filed a complaint with the World Trade Organization.

Other nations, like as Canada and Mexico, negotiated to lessen the harm while simultaneously diplomatically pushing back.

Professional Views on Long-Term Impacts

According to trade experts, tariffs must to be targeted precisely and included in larger diplomatic initiatives. Many contend that cooperation and multilateral accords are essential to the long-term viability of international trade, even when tariffs may yield temporary political benefits.

Additionally, some analysts caution that the tendency toward unilateral tax could hasten the fragmentation of the world economy.

What It Signifies to You

Even though the tariff game involved intricate economic strategies and high-level talks, the typical consumer was impacted in a number of ways.

- Price increases: Tariffs increased the cost of goods that customers ultimately pay for, such as groceries and gadgets.

- Changes in the labor market: While certain areas, including retail and agriculture, experienced difficulties, others enjoyed job growth or preservation.

- Product availability: As businesses modified their supply chains, some imported commodities became more expensive or scarcer.

- Impacts of investments: Companies halted plans for expansion, which may have an impact on innovation and employment development.

Gaining an understanding of these processes enables workers and consumers to participate in trade policy and economic priorities conversations more successfully.

In conclusion

One of the most significant trade experiments in recent decades was his tariff game. It raised important questions on economic sovereignty, national security, and the fairness of international trade. Reviving specific industries and requiring renegotiations were some of its objectives, but it also brought costs and uncertainty that were felt globally.

For many years to come, the effects of this tariff tactic will be felt in U.S. trade policy. It serves as a reminder that decisions made in one nation can have an impact on millions of lives across continents in our interconnected global economy.

Being aware of these regulations is crucial for you as a customer or business owner. Trade choices influence not only economic data but also day-to-day experiences, such as what you purchase, how much you pay, and the employment opportunities in your neighborhood.

It will continue to be a difficult task to strike a balance between cooperation and protection as the world develops. There are victors and losers in the dynamic tale of globalization, but the stakes are always high for both countries and individuals. The tariff game was only one chapter in this drama.