For stock market investors throughout the world, 2025 is looking to be one of the most exciting years yet. Investors are searching for the highest return stocks in 2025 as global economies recover from inflationary pressures, technology advancements upend industries, and new government regulations reorient trade and energy agendas.

Finding businesses with sustainable growth, solid fundamentals, and innovative potential that can continue to produce results over the long run is more important than simply following current trends when selecting stocks.

The top maximum return stocks for 2025 will be discussed in this blog, along with the factors that could contribute to their possible growth, worldwide market trends, and expert and analyst predictions for the upcoming months and years.

This article will help you make better choices when creating a high-return portfolio, regardless of your level of experience.

Table of Contents

The Significance of 2025 for Stock Investors

Let’s first examine why 2025 is so significant in the world of international investment before getting into the equities themselves.

- AI and Tech Boom: Cloud computing, automation, and AI are predicted to take over sectors and generate trillion-dollar opportunities.

- Green Energy Transition: As governments work to achieve carbon neutrality, renewable energy firms stand to benefit greatly.

- Healthcare Evolution: As biotech and healthcare technology companies create ground-breaking therapies and diagnostics, investor interest is growing.

- Growing Consumer Demand: The expansion of the middle class around the world is driving up demand for travel, entertainment, banking, and e-commerce.

- Fintech and Crypto: A new era in finance is being shaped by blockchain-based solutions, digital payments, and decentralized finance (DeFi).

Let’s examine the 2025 maximum return stock selections while keeping these elements in mind.

Nvidia (NVDA): The Superpower in AI

Nvidia is one business that will be very noticeable in 2025. Nvidia, best known for its GPUs, has emerged as the foundation of artificial intelligence, enabling improved robots, data centers, and driverless cars.

Why It’s a Great Choice:

- The use of AI is growing rapidly.

- powerful control over high-performance chips.

- alliances with top tech companies.

Expert Insights: Due to demand from cloud services, research, and AI companies, analysts predict that Nvidia’s revenues will quadruple over the next several years.

Growth Potential: If AI adoption keeps up its current rate, there might be high double-digit returns.

Tesla (TSLA): More Than Just Electric Vehicles

Tesla is more than simply a car manufacturer now. It is a leader in energy and AI technology.

Why It’s a Great Choice:

- increasing EV supremacy worldwide.

- expanding battery and solar companies.

- AI integration with autonomous driving.

Expert Views: Despite its volatility, Tesla has the potential for long-term development due to its capacity to scale innovation.

Growth Potential: Medium to high; ideal for long-term investors who can tolerate brief swings.

Apple (AAPL): The Technological Powerhouse Reimagined

Apple’s inventiveness never ceases to astound investors. The business is placing significant bets on AI, AR/VR, and subscription services in addition to iPhones.

Why It’s a Great Choice:

- Devoted clientele.

- sound financial standing.

- entering new markets, such as those for augmented reality.

Expert Insights: Within a few years, experts believe Apple’s recurrent revenue from services will overtake hardware sales.

Growth Potential: It’s a good choice for 2025 because of its steady but moderate returns.

Microsoft (MSFT): The King of AI and the Cloud

Another huge beneficiary of the AI revolution is Microsoft. With Office 365, Azure cloud services, and significant investments in AI, Microsoft is well-positioned to provide steady growth.

Why It’s a Great Choice:

- Product integration of AI.

- increasing market share for cloud computing.

- robust uptake across the enterprise.

Growth Potential: Lower risk than high-volatility stocks, consistent high returns.

Amazon (AMZN): The Titan of Cloud Computing and E-Commerce

Cloud computing (AWS) and e-commerce are still dominated by Amazon. It is a formidable competitor due to its increasing emphasis on AI, logistics, and subscription services.

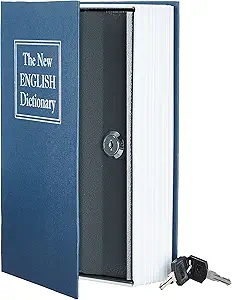

Amazon Basics Book Safe, Money Saving Box, Save for Money, Secret Hidden Metal Lock Box, Money Hiding, Key Lock, Large, Blue

- Portable lock box that looks like a book; great for hiding small valuables on a bookshelf

- Fabric cover and spine designed to look like a book; does not contain paper pages; recommended to store in-between two books on a bookshelf

- Front cover lifts to reveal safe’s actual cover; key lock designed to deter theft; 2 keys included

Why It’s a Great Choice:

- The expansion of e-commerce is unstoppable.

- When it comes to cloud services, AWS leads the market.

- AI-driven advancements in retail and delivery.

Growth Potential: Moderate to high, particularly if 2025 sees a rise in global consumer expenditure.

Meta Platforms (META): The AI Challenger & Metaverse

Despite its ups and downs, Meta is an intriguing long-term investment due to its move towards AI-driven social media and virtual reality.

Why It’s a Great Choice

- Extension of the metaverse.

- social media platform monetization.

- tools for content driven by AI.

Expert Views: Although dangerous, Meta’s long-term strategy may yield significant benefits.

Alphabet (Google):

The AI Search & Cloud Innovator Alphabet, the parent firm of Google, is still a wealthy behemoth that leads the fields of AI, cloud computing, and advertising.

Why It’s a Great Choice:

- Supremacy of search engines.

- YouTube’s expansion as a content source.

- Cloud and Google Workspace AI integration.

Growth Potential: Low risk of downside and strong, consistent returns.

COSLUS Water Dental Flosser Teeth Pick: Portable Cordless Oral Irrigator 300ML Rechargeable Travel Irrigation Cleaner IPX7 Waterproof Electric Flossing Machine for Teeth Cleaning C20(F5020E)

| Brand | COSLUS |

| Power Source | Battery Powered |

| Special Feature | Multiple Operation Modes, Multiple Pressure Settings, Multiple Tips, Portable, Lightweight, Noiseless, Non-Slip Grip, Rechargeable, Battery Indicator, Rotatable TipMultiple Operation Modes, Multiple Pressure Settings, Multiple Tips, Portable, Lightweight, Noiseless, Non-Slip Grip, Rechargeable, Batt… See more |

| Product Benefits | Gum Health, Prevents Bad Breath, Prevents Cavities, Removes Plaque, Removes Teeth Stains, Whiten TeethGum Health, Prevents Bad Breath, Prevents Cavities, Removes Plaque, Removes Teeth Stains, Whiten Teeth |

| Unit Count | 1.0 Count |

Pfizer (PFE): Development in Biotechnology and Healthcare

In 2025, healthcare stocks will be very important, and Pfizer is at the forefront thanks to its leadership in vaccines and biotech research.

Why It’s a Great Choice:

- Pipeline expansion in immunology and oncology.

- growth in the need for healthcare worldwide.

- dividend stock that is steady.

Growth Potential: A defensive stock that is strong but not very strong.

BYD (Build Your Dreams

There are other EV players besides Tesla, including the Chinese EV giant BYD (Build Your Dreams). BYD is in the news because of its robust demand in China and elsewhere.

Why It’s a Great Choice:

- Increasing the global market share of EVs.

- Chinese government assistance.

- reasonably priced in contrast to Tesla.

Growth Potential: Excellent, particularly for investors in emerging markets.

Ethereum (ETH): The Story of Crypto Growth

Crypto continues to draw investors in addition to stocks. Ethereum serves as the foundation for DeFi, NFTs, and smart contracts, making it more than just a cryptocurrency.

Why It’s a Great Choice:

- widespread use of blockchain technology.

- robust ecosystem for developers.

- Institutional investment increases.

Growth Potential: High risk, high payoff.

Comparing the US, European, and Asian markets in 2025

- AI, technology, and green energy stocks are driving the US market.

- European Market: More conservative, with an emphasis on banking and the energy transition.

- Asian Market: Rapid expansion in manufacturing, tech companies, and EVs.

Opportunities for diverse portfolios that combine Asian growth stories with US tech giants are created by this global balance.

Professional Views on 2025 Maximum Return Stocks

- Optimists: Think that record-breaking market returns will be driven by AI, EVs, and green energy.

- Skeptics: Alert them to the dangers of market corrections and the overvaluation of tech stocks.

- Balanced Opinion: Advocate for a diverse portfolio that includes exposure to technology, healthcare, energy, and finance.

What Might Impact 2025 Maximum Return Stocks?

- Interest rate changes: Growth stocks may be slowed by higher rates.

- Geopolitical Tensions: International supply chains may be impacted by trade disputes and wars.

- Regulations: Tighter laws pertaining to big tech, AI, or cryptocurrency may change the game.

- Consumer Trends: Industries may succeed or fail based on shifting demand trends.

Concluding remarks

In 2025, investing in stocks with the highest potential returns necessitates striking a smart balance between risk management and high growth pursuit. While tech behemoths like Tesla, BYD, and Meta provide high-risk, high-reward chances, tech titans like Nvidia, Microsoft, and Apple offer stability and innovation. Returns can be further diversified by including cryptocurrency and healthcare assets.

The most important lesson? 2025 will be a year of innovation, diversification, and astute investing. There is a chance to maximize returns whether you are a risk-taker or a conservative investor as long as you make informed decisions.