Looking to grow your savings consistently over time? A SIP calculator can help you estimate future returns and make informed investment decisions. Whether you’re investing for retirement, a home, or education, our tool gives you clarity in seconds.

✅ Try Our Free SIP Calculator

👉 Enter your investment amount, expected annual return, and tenure below:

Table of Contents

📌 What Is a SIP?

A Systematic Investment Plan (SIP) allows investors to put a fixed amount into mutual funds or ETFs regularly—monthly, quarterly, or yearly. It’s a disciplined, low-risk way to build wealth gradually through compounding returns.

📈 Why SIP Is Smart in 2025

Here’s why SIPs remain a powerful investment strategy:

- Rupee Cost Averaging: You buy more units when prices are low and fewer when high, reducing average cost.

- Compounding Power: Long-term growth is amplified by compounded returns year after year.

- Regular Discipline: Investing small amounts regularly is easier than one-time lump sums.

- Low Entry Barrier: Most funds allow SIPs from ₹500 or $50 monthly.

- Goal-Based Planning: Perfect for milestones like retirement, children’s education, or vacation.

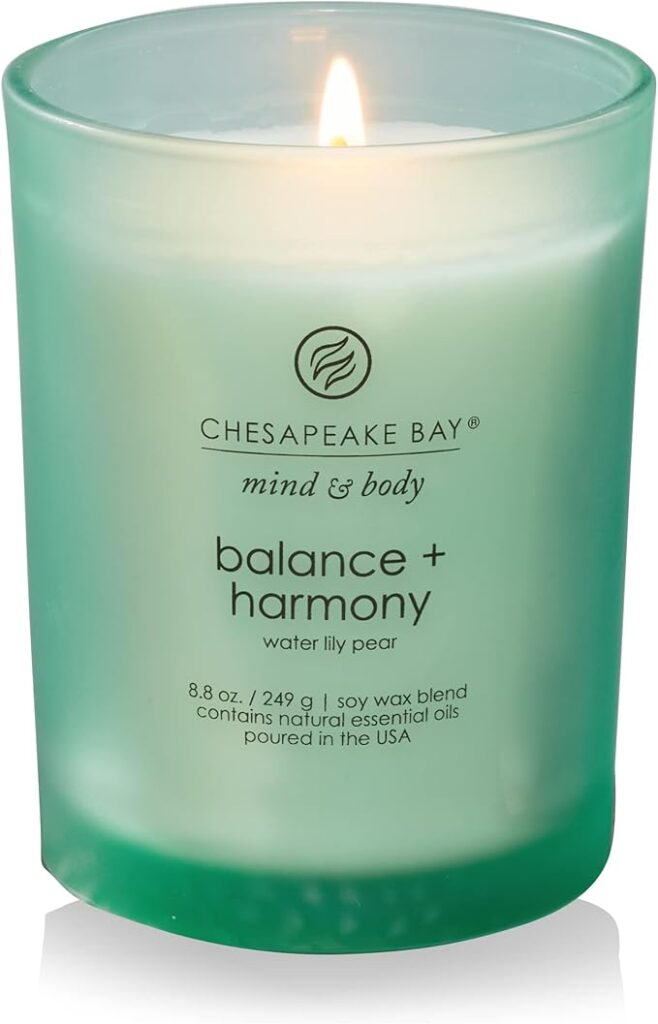

Chesapeake Bay Balance + Harmony Scented Candle Water Lily Pear Fragrance 50 Hours Burn Time Warm & Decorative Soy Wax Blend

Fragrance Profile: Juicy tropical fruits, ripened peach, delicious pear, combined with Rose, Violet, Waterlily, Cyclamen, featured in base notes of Sandalwood, Green Foliage, and Rosewood

🚀 How to Use Our SIP Calculator

Our SIP calculator is designed to be simple yet powerful:

- Enter the monthly investment amount (e.g., ₹5,000 or $100).

- Choose the expected annual return (e.g., 10%).

- Set the investment period (in years or months).

- Click “Calculate”.

You’ll instantly see:

- Future corpus value

- Total invested amount

- Total returns earned

Experimenting with different inputs helps you create realistic investment plans.

💡 SIP vs Lump Sum: Which Is Better?

| Feature | SIP | Lump Sum |

|---|---|---|

| Market Timing Risk | Low | High — timing matters |

| Discipline | High | Easy to delay |

| Compounding Effect | Strong over time | Depends on entry returns |

| Emotional Stress | Low | Potential regret during drops |

For most new and risk-averse investors, SIP is the preferred method due to its steady approach and reduced emotional volatility.

🎯 Benefits of Starting SIP Early

- Time is your friend: The earlier you start, the longer compounding works for you.

- Lower monthly commitments: Even ₹1,000/month can grow into crores with discipline.

- Flexible exit: You can redeem partially or pause anytime with many mutual funds.

- Tax benefits (where applicable in some countries for recurring investments).

🧠 Real-Life Example Using the SIP Calculator

Example Scenario:

- Monthly investment: ₹5,000

- Annual return: 12%

- Investment period: 10 years

Using our calculator, you may see:

- Total investment: ₹6,00,000

- Estimated corpus: ₹13,48,000

- Returns earned: ₹7,48,000

This transparent view helps you adjust your inputs until your goals align with projected outcomes.

📝 How to Choose the Right SIP Plan

When selecting a SIP fund, consider:

- Fund category (Large-cap, mid-cap, balanced, index fund) – align with your risk profile.

- Historical returns of at least 5+ years.

- Expense ratio – lower is better.

- Fund manager’s track record.

- Exit load / lock-in – especially for tax-saving funds.

⚠️ Tips to Maximize SIP Returns

- Stay invested for at least 5 years – short-term volatility can hurt performance.

- Review performance annually – but avoid making emotional decisions.

- Increase SIP amount periodically – match SIP with income growth.

- Use top-performing, low-cost funds optimized for goals.

- Rebalance your portfolio if underperforming or asset mix shifts.

🧬 Combining SIP with Other Financial Goals

- Retirement Planning: SIP into equity and balanced funds gradually over decades.

- Child’s Education: Start early, increase contributions as income grows.

- Emergency Fund: Combine SIP with liquid funds for easy access.

- Debt Management: SIPs can complement EMI and savings for major expenses.

📊 Limitations & Considerations

While SIP is effective, keep these in mind:

- Returns aren’t guaranteed – markets fluctuate.

- Inflation-adjusted returns: 10% return means less buying power over time.

- System risk: Fund houses may merge or governance may change.

- Over-diversification: Too many funds can lead to confusion.

🤔 Frequently Asked Questions

Q. Can I withdraw SIP anytime?

Yes. Most funds allow redemptions without penalty, though some tax-saving plans have lock-in periods.

Q. Is SIP tax-saving?

Depends on your jurisdiction and fund type. Some equity-linked SIPs offer tax benefits after specifying lock-in periods.

Q. What if I miss a SIP payment?

Many platforms automatically retry or prompt you. Small delays are usually okay—but avoid frequent misses.

Q. Can I automate switching between funds?

Yes. Many platforms let you set a trigger to switch from equity to debt funds as you near your goal.

🧭 Final Thoughts

SIPs remain one of the most powerful yet easy ways to invest regularly and build wealth over time. By combining disciplined investment through SIPs and carefully choosing funds, you can reach your financial goals without needing market timing or large capital upfront.

Use our free and accurate SIP calculator to plan your ideal investment based on your unique goals and timeline. Start today, adjust as life changes, and watch your savings grow steadily.

✅ Ready to Build Your Wealth?

👉 Click here to use our SIP Calculator and plan your future with confident